In the 2018 court case, South Dakota v. Wayfair, the Supreme Court ruled that states can mandate businesses that have “nexus” in a state to collect and remit sales taxes on transactions to customers in that state. Prior to this ruling, nexus was created based on “physical presence” in a state but is no longer required for businesses that have nexus based on an “economic connection” to a state.

Sales tax nexus occurs if a business has “significant” presence or connection in a state and must comply with that state’s sales tax law. Although each state has slightly different definitions of sales tax nexus and some none at all, most states consider “physical presence” or an “economic connection” as having nexus in their state.

A business may have sales tax nexus by having physical presence in a state such as an office, employee, warehouse or inventory storage, affiliates, and even temporary business such as tradeshows. As mentioned earlier, physical presence was required for a business to have nexus prior to the ruling, so this is not really new news.

The ruling now allows states to create sales tax nexus through their own definition of an economic connection, which is determined by a certain dollar amount in sales or specific number of transactions. The most common economic nexus threshold for states is sales over $100,000 or 200 sales transactions. Although the ruling is not retroactive and does not require collection and remittance of previously purchased items, it will impact many retailers in the coming years – especially those that sell to many different states online.

It is important to note that although a business may sell and ship to customers in various states, the business is not required to collect and remit sales tax to those states until their economic connection is significant (ex. when sales exceeds $100,000 or transactions exceed 200 in that state).

Sales tax is governed at the state level, and each state has its own laws for tax administration. Because of this, tax varies from state to state based on various items such as sales tax rates, taxability of certain products and services, the frequency of sales tax returns and their due dates. Once the business has determined it has nexus in a state, it is required to:

- Determine the taxability and tax required to be collected

- Register for a sales tax permit in that state

- Collect sales tax from buyers or customers if an item is sold or shipped to that state

- Remit those sales taxes to that state in accordance with that state tax laws

- File sales tax returns

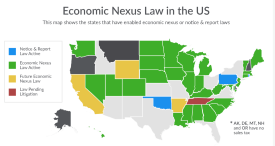

The ruling is still relevantly new and there are many states are only beginning to follow suit after South Dakota which means there may be many changes in the coming years. It is important to keep track of sales tax law in states your business may be affected by and consult with professionals in order to remain compliant with the changing state economic nexus laws.

For information on filing thresholds, effective dates and more detailed information on each state visit The Sales Tax Institute’s Economic Nexus Resource State Guide.