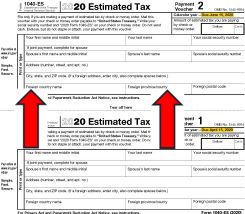

IRS is now joining CA with postponing 2020 Q1 estimate due 4/15 to be paid 7/15.

Quick Summary of all IRS and CA Updates:

• Need to file an extension to avoid late filing penalty.

• No late payment penalties or interest for 2019 balances due if paid by 7/15 for IRS and CA.

• 2020 Q1 estimated taxes can be postponed from 4/15 to 7/15 for Fed and CA

• 2020 Fed Q2 estimated taxes are still due 6/15.

• 2020 CA Q2 estimated taxes are postponed from 6/15 to 7/15

• C-Corps have different rules, see prior posts.

• A Treasury proposal circulated Wednesday 3/18 that envisions two rounds of payments, one starting April 6 and one starting May 18, around $1K. Noting official passed.

• Watch out for scammers with COVID-19 IRS scams, please check with us for anything unusual.

• IRS is processing refunds and we are working as fast and as long as we can to keep up with this surge of processing tax returns.